Unexpected, yet real - Internet-based task is not the maintain of the young " electronic citizen" generation alone. A 2008 survey claims that Generation X (those birthed in between 1965 as well as 1976) makes use of Electronic banking substantially more than any other market segment, with two thirds of Net users in this age financial online.

Gen X individuals have actually also professed their preference for applications such as Facebook, to share, connect and also become part of a bigger community.

This is some irony in this, considering that online banking, as we understand it today, supplies very little interactivity. Unlike in a branch, where the comfort of 2 way communication promotes the consummation of a selection of purchases, the one means road of e-banking has just managed to allow the more regular jobs, such as balance enquiry or funds transfer.

It's not hard to put two and two together. A clear chance exists for financial institutions that can transform today's passive Internet banking offering right into one that gives a extra prevalent as well as interactive consumer experience.

It is consequently crucial that financial institutions change their on the internet offering, such that it matches the brand-new expectations of customers. Furthermore, Electronic banking need to trip to prominent on the internet customer hangouts, instead of wait on clients to find to it.

There are clear indicators that the shift towards a " future generation" online banking atmosphere has already been set in motion. It is only a issue of time before these fads end up being the standard.

Leveraging of Social Networks

Forward assuming banks are leveraging existing socials media on exterior sites to increase their exposure among interested groups. They are likewise releasing social software innovation on their own websites to engage the same neighborhoods in two method discussions. Hence, their Internet banking has presumed a much more pervasive character - clients are involving with the financial institution, together with its services and products even when they're not actually transacting online.

Intense exposure apart, banks can gain incredible customer understanding from such disorganized, casual communications. As an example, a conversation on the unclear monetary future amongst a group of 18 to 25 year olds could be a signal to banks to supply long term investment items to a section that was formerly not considered a target. Going one action additionally, a favorable buzz around a recently launched solution can create valuable word-of-mouth advertising for business.

Collaborating via Internet 2.0

The collaborative aspect of Web 2.0 applications has made it possible for financial institutions to draw customers inside their fold more than ever in the past. Standard methods such as focus group discussions or marketing research suffer from the disadvantages of high cost, limited range and possibility to present bias. Comments kinds merely work as a post-mortem. On the other hand, Web 2.0 has the ability to carry a large audience along right from the start, as well as remain to do so constantly. Therefore, an interested neighborhood of leads and also consumers take part in co-creating product or services which can meet their expectations.

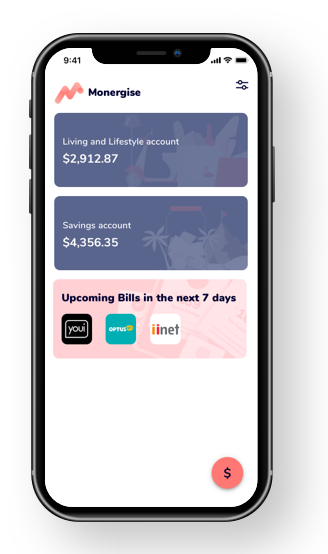

The prevalence of Internet 2.0 makes it possible for delivery of e-banking across several on the internet areas and web-based gadgets such as Yahoo!Widgets, Windows Live or the apple iphone. This implies future generation online banking clients will certainly appreciate increased access and also ease

A New York based firm of analysts discovered that 15% of the 70 financial institutions tracked by them had actually embraced Internet 2.0, a number of them having done so within the last one year.

Requirement Chartered Teller connect with their colleagues through Facebook and make use of the system to share understanding, clarify questions and also participate in discussions on recurring firm activities.

Bank of America, Wachovia Financial Institution as well as Republic Credit Union have actually developed a existence within interactive media to produce recognition and keep up a dialogue with interested communities. They have actually employed a selection of approaches, varying from producing YouTube neighborhoods to releasing projects on Present TV, a network in which visitors figure out content.

Personalisation of Online Banking

Vanilla e-banking splits clients into large, heterogeneous teams - commonly, company, retail or SME, with one kind of Internet banking web page for every. That's in sharp opposition to how financial organisations would like to view their clientele. Financial institutions are relocating towards customer-specificity, almost viewing each customer as a " sector of one", throughout various other channels, and also electronic banking is readied to do the same. As an example, a specific home page for mortgage customers as well as one more for private banking clients can well be a possibility in future.

Surprisingly, National Financial Institution of Kuwait had the foresight to do this a number of years ago - they made it possible for customers to identify which items they would certainly view and gain access to, as well as were awarded with a significant boost in on-line purchases.

Cash Monitor from Yes Financial institution permits customers to select their touchdown page - as an example, they can establish "all deals", " total assets" or " profile" as their default sight. Other attributes consist of the ability to categorise purchases according to clients' comfort as well as the printing of personalized records.

Empowerment Online

Definite, Internet banking has actually developed a extra educated, empowered class of clients. This is readied to reach the next level once clients are permitted to proactively take part in a lot more transaction-related processes. The Net has already made it possible for customers to compare item car loan offerings, imitate economic situations as well sandstone technology as layout custom-made retired life profiles. Going forward, they would be able to skilled relevant transactions - which implies, after comparing rate of interest, they could stem a funding online, and also as soon as safeguarded, they can start to settle it online as well.

Portalisation

The appearance of Internet 2.0 innovation coupled with banks' desire to personalise their e-banking to the highest degree is most likely to result in "portalisation" of Electronic banking. The idea of financial consumers being able to create their very own areas online, filled with all that pertains to them, is not that improbable. Clients can personalise their Electronic banking page to mirror the placements of multiple accounts throughout different financial institutions; they might include their charge card details, register for their preferred monetary news, consolidate their physical assets setting, share their experiences with a team as well as do even more - all from one " area".

Money Monitor makes it possible for customers to add numerous "accounts" (from a option of 9,000) to their web page. Accounts could be savings or funding accounts with major Indian financial institutions, or those with utilities service providers, credit card business, broker agent companies as well as also frequent leaflet programs. Customers can tailor-make their web pages as defined previously.

As banks seek to establish their Electronic banking vision for the future, in parallel, they will also need to resolve the crucial concerns of security and "due support". While it is every online marketer's desire to have clients work as ambassadors, appropriate preventative measure has to be required to prevent the expansion of harmful or spurious attention. Therefore, before an person is enabled to participate in a networking discussion forum, he or she should have accumulated a favorable performance history with the financial institution. The specific must be a acknowledged customer of the bank, having actually made use of a minimal variety of products over a reasonable length of time. Qualitative information concerning the person's interaction with the bank's assistance staff ( for instance regularity and type of phone calls made to their phone call centre, outcome of such interaction and more) might be vital in profiling the " best" type of customer that can be hired as a feasible advocate.

Collective Web 2.0 applications might demand opening banks' internet sites to outside innovation as well as info exchange with 3rd party sites, increasing the specter of information and facilities safety. A robust device of checks and also balances must be constructed to ensure that the 3rd party websites are safe and secure, suitably accredited and present no hazard to the house banks' websites. Similarly, prior to a 3rd party widget is allowed to be caused to a website, it has to have travelled through stringent safety and security control.

Due diligence needs to be exercised before permitting users to put a link to an additional site to guard against the opportunity of unintentional download of harmful software, which could, in the worst situation, even lead to phishing originating from the banks' sites.

It is similarly important for a bank to safeguard its clients versus invasion of personal privacy, data theft or abuse. The idea of portalisation imagines deploying modern technology to bring details from other banks' or economic provider' sites into the home financial institution's site. The house financial institution have to guarantee that its consumers' personal or purchase related information, which may be shared with the various other companies, is not vulnerable to leak or straight-out misuse.

Financial institutions will succeed to partner with an Electronic banking solution supplier which has not just the experience to translate their vision into a cutting side e-banking experience for the user, yet likewise the insight to specify borders for security. With safety worries appropriately addressed, next generation Internet banking contains amazing possibilities. Financial institutions that seize the opportunity might find that Internet banking can become a way of differentiating themselves from rivals, as opposed to a plain price cutting tool. Plainly, providing a much more powerful as well as interactive e-banking experience, is the means forward.